Mutual Funds Marketplace

Products

The Mutual Fund Marketplace:

More Funds = More Opportunities

The IBKR Advantage

- 50,000 + Funds available to residents worldwide

- 20,000 + Funds with no transaction fees

- Other funds available at low commissions and no custody fees

- IBKR is neutral – no proprietary funds

- Free Mutual Fund Search tool to help you find the right funds

- Rated Best Online Broker for Mutual Funds by Benzinga

No Custody Fees and Low, Transparent Commissions on Mutual Funds

Inside the US: The lesser of USD 14.95 or 3% of trade value

Outside the US: EUR 4.95 or currency equivalent

50,000 + Mutual Funds from over 500 fund families

IBKR has one of the largest Mutual Fund Marketplaces, with funds from Allianz, American Funds, BlackRock, Fidelity, Franklin Templeton, Invesco, MFS, PIMCO, Vanguard and many others. In addition, the Marketplace is neutral – there is no conflict of interest as we don’t offer proprietary funds.

- 50,000 + funds from over 500 fund families

- 20,000 + with no transaction fees

- Available to residents worldwide

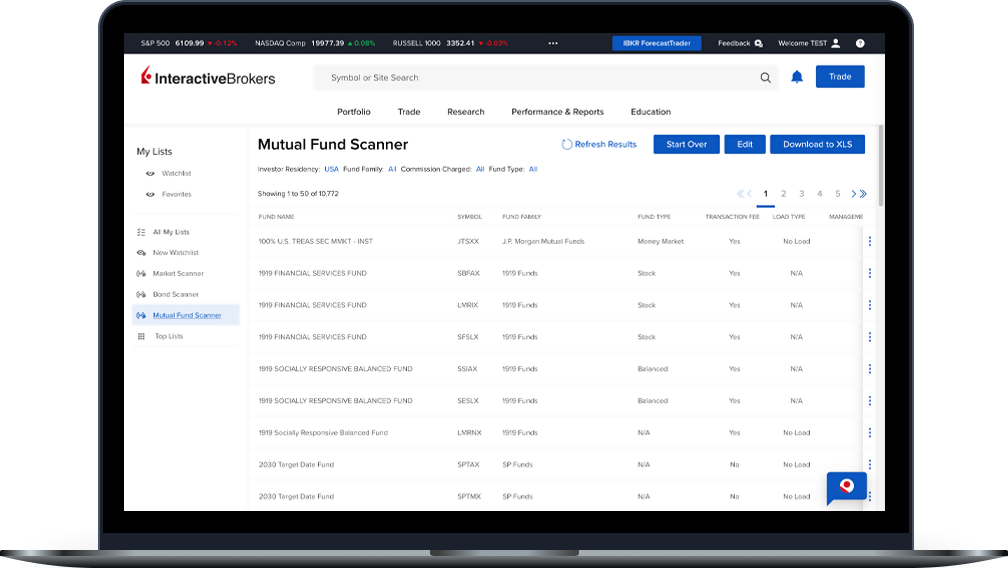

Free Mutual Fund

Search Tool

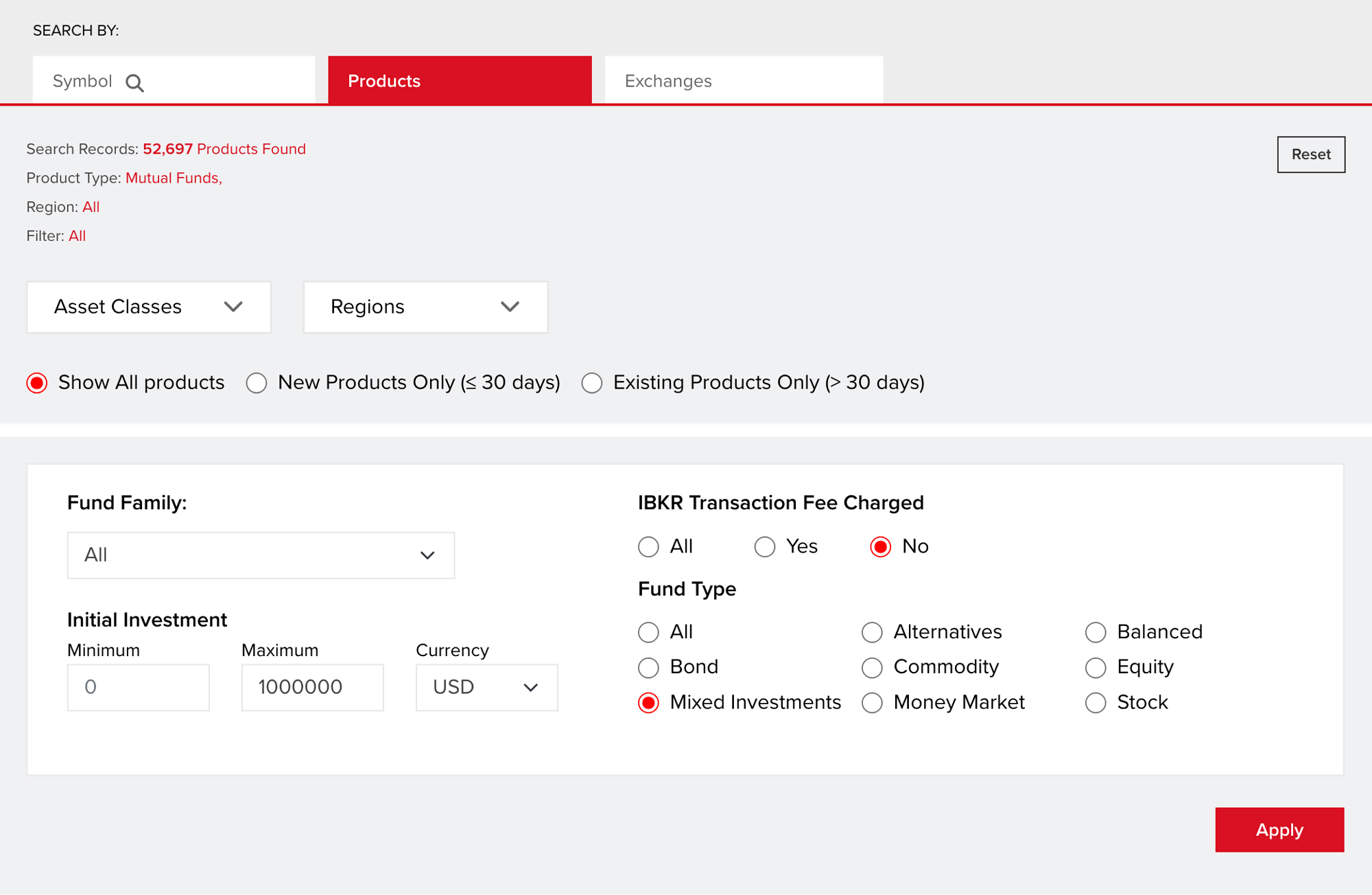

Use our Mutual Fund Inventory Search Tool to identify funds by country of your residence, commission charged, fund type or fund family.

What Are Mutual Funds?

Mutual funds are investment vehicles that pool money from many investors to buy a diversified portfolio of stocks, bonds or other securities.

A mutual fund typically holds a wide variety of securities within and/or across sectors, helping reduce the impact of any single asset’s performance on the overall fund. Each investor in the fund owns a share of the fund, which represents a proportion of the fund’s holdings.

Mutual funds are professionally managed by a fund manager who makes decisions on behalf of the investors. Funds can be actively managed, where fund manager attempts generate fund performance that outperforms a specific benchmark such as the S&P 500, or passively managed, where the fund manager seeks to match the performance of a specific benchmark such as the Dow Jones Industrial Average.

Most mutual funds charge a management fee. Some may be “no load,” which means they do not charge a sales commission or fee when you buy or sell shares, while others may have additional charges like sales loads or redemption fees.

How Do You Buy Mutual Funds?

You can buy mutual funds through several common methods:

Brokerage Accounts

Most online brokerages, including Interactive Brokers, let you purchase mutual funds directly. You can browse available funds, place an order to buy shares, and manage your investments all in one place.

Directly from Fund Companies

Many mutual fund providers allow you to open an account on their website and buy their funds without a middleman.

Through Financial Advisors

If you work with an advisor or financial planner, they can recommend and purchase mutual funds on your behalf.

Employer-Sponsored Retirement Plans

Many 401(k) or similar plans offer mutual funds as investment options, and you can allocate your contributions accordingly.

When buying mutual funds, you will usually need to meet a minimum investment amount, which varies by fund. Purchases are processed at the fund’s net asset value (NAV) price, which is calculated at the end of each trading day.

What Are the Benefits and Risks of Mutual Funds?

Investing in mutual funds offers the benefit of professional management and diversification, which can help reduce the risk associated with individual securities. However, mutual funds are still subject to market risk, meaning the value of your investment can go down depending on overall market conditions. Additionally, fees and expenses can reduce your returns over time. While mutual funds provide a convenient way to access a broad range of investments, it is important to understand that they do not guarantee profits and investors can lose money.

Interactive Brokers’ Education and Resources for Mutual Funds

Traders' Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on stocks, including an introductory course on Mutual Funds.

Mutual Fund Search Tool

Interactive Brokers offers access to over 50,000 mutual funds from over 500 fund families, including more than 20,000 funds with no transaction fees. Our Mutual Fund Search Tool makes searching this extensive inventory straightforward. Search parameters include region, fund family, minimum or maximum initial investment, transaction fees, and fund type.

Start trading like a professional today!

Open an AccountDisclosures

Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds’ assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please view our Mutual Fund Product Listings.

Mutual funds trade once per day. Each fund has a cut off time, after which an instruction to buy or sell cannot go through until the next day. Any attempt that you make to cancel or modify an order will be considered a request to cancel or modify that order. We will do our best to meet your request but cannot guarantee that your order can be changed or cancelled, even where the request is submitted before the cut off time. We shall not be liable to you if we are unable to cancel or modify an order. You remain responsible for executions even where you have made a request to cancel or modify an order.