Advisor Welcome Center

Advisor Welcome Center

Advisors on the IBKR platform use our turnkey custody solution to build competitive advantage, efficiently manage their business and serve clients at lower cost.

This page provides information, tools and resources to help you configure and customize your account, onboard and manage clients, configure CRM, fund accounts, subscribe to market data, run reports, trade and more.

Getting Started

Advisor Portal is our free and powerful client relationship management (CRM) platform for advisors. Our web application serves as your one-stop destination to manage clients, check quotes and place trades, see account balances, P&L and key performance metrics, funding, reporting, and more. Portal is always available from the Login button on our website.

Configuring Your Account

User Access Rights

Once your account is approved and opened, your organization's security officer(s) can create and add users to an account and manage user access to account trading, reporting, funding, and settings, and configure client-specific access.

White Branding

Learn how to white brand your client statements, registration and other materials with your own organization's identity, including on performance reports created by PortfolioAnalyst.

Client Relationship Management (CRM)

Client Relationship Management

Advisor Portal offers an integrated suite of tools for managing the client acquisition and client relationship management lifecycle:

- Dashboard is a single point of access for quickly and easily managing client information.

- Manage your contacts for both your prospects and your clients.

- Implement flexible fee structures, automate fee administration and invoicing, and setup client fee templates to simplify fee administration.

Advisor Portal also includes a number of other features:

- Link client accounts under a single username and password.

- You can opt to setup your CRM notes and email on Rackspace, a leading managed cloud solution provider.

- Use the Client Risk Profile to better understand client risk tolerances and recommend suitable investments for your clients.

- Our ESG Impact Preferences tool can be used to gather information on client preferences related to sustainable, socially responsible investing.

- Use the Account Queries tool to search for accounts or information on accounts, using a variety of criteria such as account type, status, margin type, beneficiary information, etc.

- Goal Tracker helps you project the hypothetical performance of a client's portfolio and monitors the likelihood of achieving their goal.

- View all client activities, including the complete order history from initiation to execution and its routing sequence, with Enhanced Client Activity Monitor (eCAM).

Advisor Service Models

Registered investment advisors can choose from three service models, which offer enhancements such as:

Operational Control

The service models allow you to complete various tasks, such as funding requests and information changes, on behalf of your clients. Once entered by the advisor, clients will use a simplified process to approve, sign and confirm your action.

An Enhanced Dashboard

The Client Pending Items tab (formerly Pending Items) on our Dashboard shows you all pending tasks for your clients and allows you, as the advisor, to complete the task on behalf of the client or send an automated email asking your client to address the task.

Improved Messaging

We redesigned our Sub Account Messages tab and streamlined communications from IBKR by aggregating, categorizing and routing messages to the advisor to avoid unnecessary client contact.

We offer three customizable participation levels:

| Authorization Level | Streamlined All-Client Enrollment | Streamlined Plus All-Client Enrollment | Full-Service Per-Client Enrollment |

|---|---|---|---|

| Overview |

Offers a simplified process for clients to approve funding requests, sign agreements and confirm changes or instructions entered by the advisor. Communications from IBKR are aggregated, categorized and routed to the advisor to avoid unnecessary client contact. Advisors can configure the specific features. |

Advisors can perform specific administrative tasks on behalf of clients. Instead of logging in to the Client Portal, clients may use a simplified approval process for tasks requiring their approval. Clients are automatically enrolled at the service level, and available authorizations are applied during the account application. |

Clients allow advisors to perform additional tasks on their behalf, including administrative tasks and the ability to move funds or assets to new places. Each client must enroll individually and select the powers they want to grant to the advisor. |

| Authorizations | |||

| Core Authorizations | |||

| Vote Shares and Make Elections Regarding Positions | |||

| Request to Send Electronic Notices, Confirmations and Account Statements only to Advisor | |||

| Update Account Information, Account Settings, Trading Permissions and Tax Forms | |||

| Special Programs and Alternative Investments | |||

| Provide or Change Banking and Transfer Instructions | |||

| Send Third Party Payments and Wires | |||

| Client Approval Method | Text Notification | Text Notification | No Approval Required |

| Auto-enroll All Clients | Yes | Yes/No | No |

| Eligibility | Advisors who are duly registered.* |

Registered Advisors with at least USD 100 million** in assets under management, including: • SEC-registered advisors • CFTC-registered advisors who are also SEC or state-registered • Advisors registered outside the U.S. | Registered advisors subject to compliance review. |

| Requirements | Advisors and clients must sign IBKR documentation. | Once the advisor is enrolled, all eligible new clients will be enrolled during the account application process and cannot opt out of the program. Existing clients must sign an addendum for authorization to apply. | Advisors must maintain professional registration status. Clients must complete and submit an executed form. |

Client Applications

Client Account Applications

IBKR offers multiple options for adding or migrating clients to our platform, including a mass upload feature and support for customized client account applications using our application XML system.

- Mass Upload lets you upload multiple client accounts to our system using a single excel workbook.

- Registered advisors can use our application XML system to integrate with their own versions of the IBKR account application. Advisors can create one or more account applications for a client and use Docusign to send everything for each account to the client on one package with all documentation for the client to sign electronically.

- Send email invitations to prospects to open an account.

- Client Account Templates let you use information you have collected about your prospects in the invitation you send them to complete an application. If you want to assist your client with the account application, our Semi-Electronic application allows advisors to complete applications electronically on behalf of clients.

Account Funding

Client Account Funding

The Transfer & Pay menu in Advisor Portal provides resources to let you transfer funds, transfer positions, check transaction status and history, submit withdrawals for both your master account and for your client accounts.

Our website provides an overview of funding methods available to clients.

Performance & Statements

Performance & Statements

The Performance & Reports menu in Advisor Portal provides access to PortfolioAnalyst®, standard Statements, Flex Queries, Tax Documents, a suite of Advisor specific reports and more.

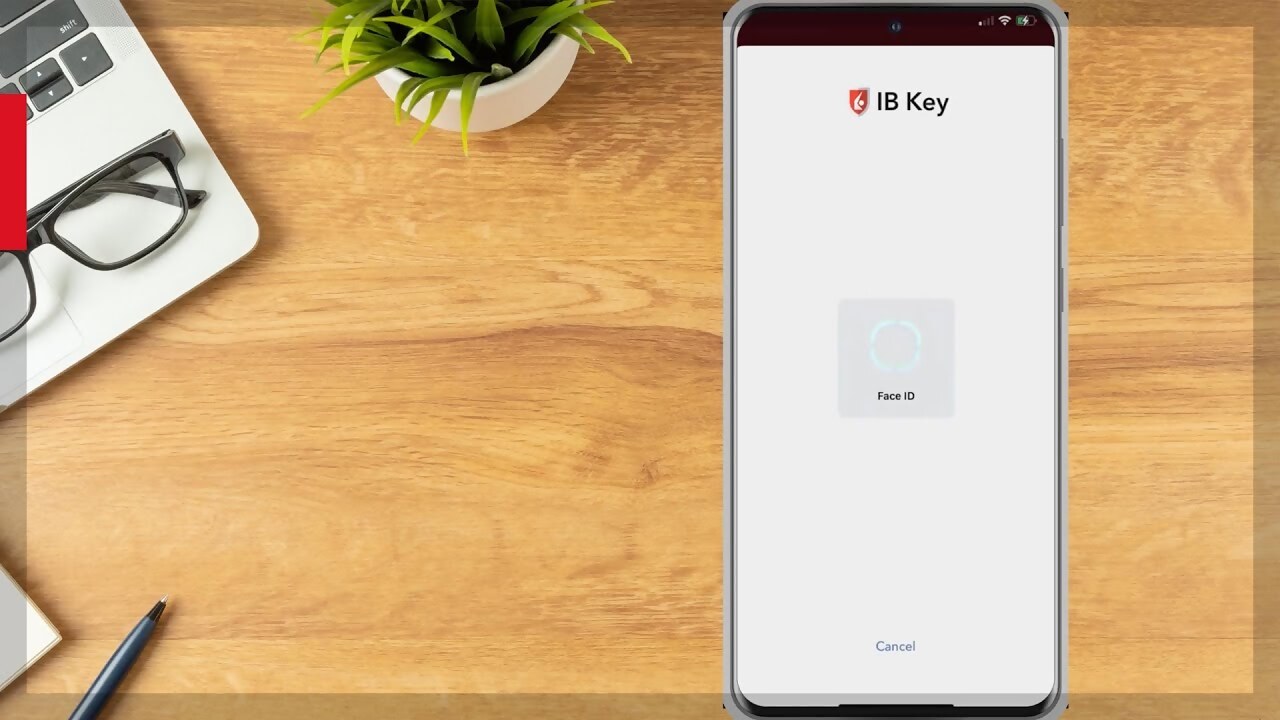

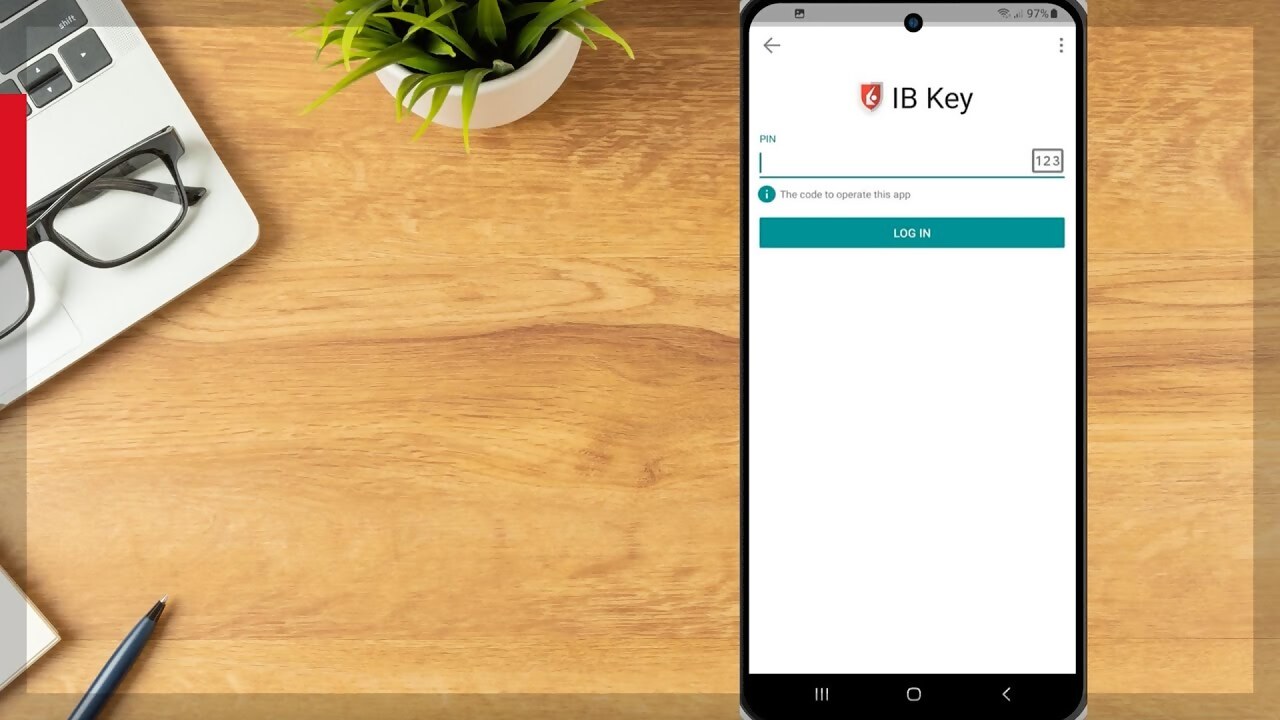

Account Security

Account Security

We are committed to protecting your account and account assets from fraudulent practices. Our Secure Login System provides Two-Factor Authentication (2FA) as an extra layer of security when accessing your account. Download our mobile app to enable 2FA.

iOS Tutorial:

Android Tutorial:

Configuring Market Data

Market Data

Use the Settings menu in Advisor Portal to manage your market data, research and news subscriptions. We provide real-time streaming market data for free or at the price we are charged by the exchange and offer access to dozens of free and premium market research and news providers.

Trade Your Account

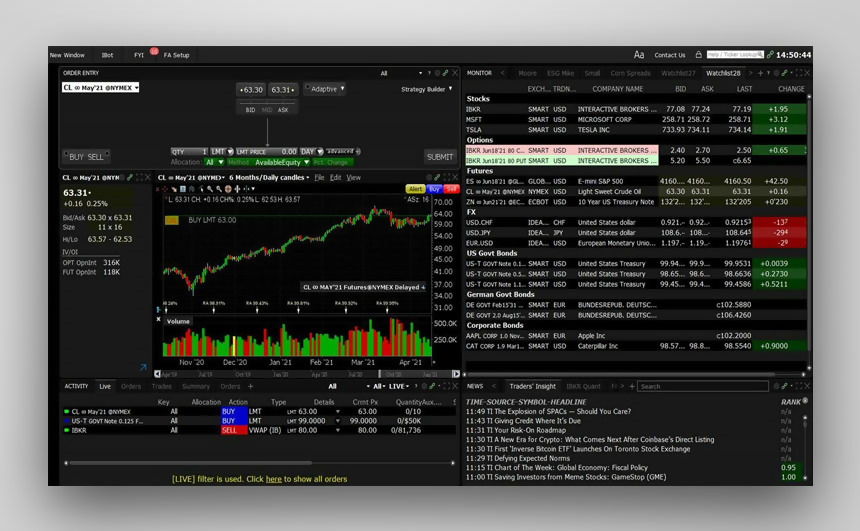

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility and incorporates a number of advisor specific features designed to streamline trading and position management, including Block Allocation, Model Portfolios and Rebalancing.

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility and incorporates a number of advisor specific features designed to streamline trading and position management, including Block Allocation, Model Portfolios and Rebalancing.

TWS Layout/Customization Tutorial:

TWS Advisor Setup Window Tutorial:

IBKR APIs

From our easy-to-use Excel API to our industrial strength FIX API, we offer something for every experience level. Our TWS API is well-supported with numerous examples to help you get started.

IBKR APIs

From our easy-to-use Excel API to our industrial strength FIX API, we offer something for every experience level. Our TWS API is well-supported with numerous examples to help you get started.

Other Features

Account Window

A configurable window in TWS for monitoring every aspect of your account activity.

Monitor Positions

The Monitor panel on the TWS houses your watch lists and your Portfolio page so you can quickly access a real-time view of your positions, P&L, liquidity, margin requirements, etc.

Block Allocations

Use our Order Allocation Tool to transform and streamline the creation, execution and allocation of group orders. Develop and deploy investment strategies in minutes across multiple client accounts with a single order, to capture opportunities in volatile markets. Alternatively, you can create Allocation Groups to allocate trades to groups of accounts based on shares, percentages, ratios.

Rebalance Portfolio

Use the TWS Rebalance window to rebalance your portfolio based on the target percentages you enter.

Model Portfolios

Streamline your workflow by investing your client assets with Model Portfolios. You can establish your own portfolio of financial instruments, and then trade this model on behalf of your clients or you can invest in Model Portfolios created by third party managers.

Paper Trading Account

Use the full range of trading facilities in a simulated environment using real market conditions.

Investors' Marketplace

The Investors' Marketplace lets advisors advertise their services to IBKR clients and connect with third party suppliers of technology, research, consulting and investment services. Our website provides an overview of funding methods available to clients.

PortfolioAnalyst

Use Advisor Portal to access PortfolioAnalyst, a comprehensive portfolio management tool that helps you quickly and easily consolidate clients' financial information from any financial institution to gain a complete portfolio view, including assets held-away.

For information on other features, including Trade in Fractions, IBKR GlobalAnalyst, the Bonds Marketplace and Mutual Fund Marketplace, visit our Features in Focus webpage.

View All Features in FocusSupport Resources

Frequently Asked Questions

Looking for an answer? Browse our extensive inventory of frequently asked questions.

IBKR Campus

Learn about the tools, markets and technology available to you with our Advisors curriculum. Stay on top of market events at Traders Insight, learn about programming at the Quant Blog, subscribe to our Podcast channel for interviews and audio articles covering the world of finance, or sign up for a complimentary webinar.

Global Product Offering

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform.

Margin Trading

IBKR offers margin rates from USD 4.83%-5.83%, the lowest margin loan interest rates of any broker,according to the StockBrokers.com Online Broker Survey 2023 Read the full article.

Support for Institutions

Browse our support page for instructional videos, user guides, release notes and information on connecting with us.

Disclosures

- Eligible advisors will be enrolled during the application.

- Registered advisors with accounts at IBIE must have EUR 50MM in assets under management. Registered advisors with accounts at IBUK must have GBP 50MM in assets under management.